Personalized advice from a dedicated financial advisor.

We get to know you and your family, your financial situation and what matters most to you.

Learn more about an advisor's background on

FINRA's BrokerCheck

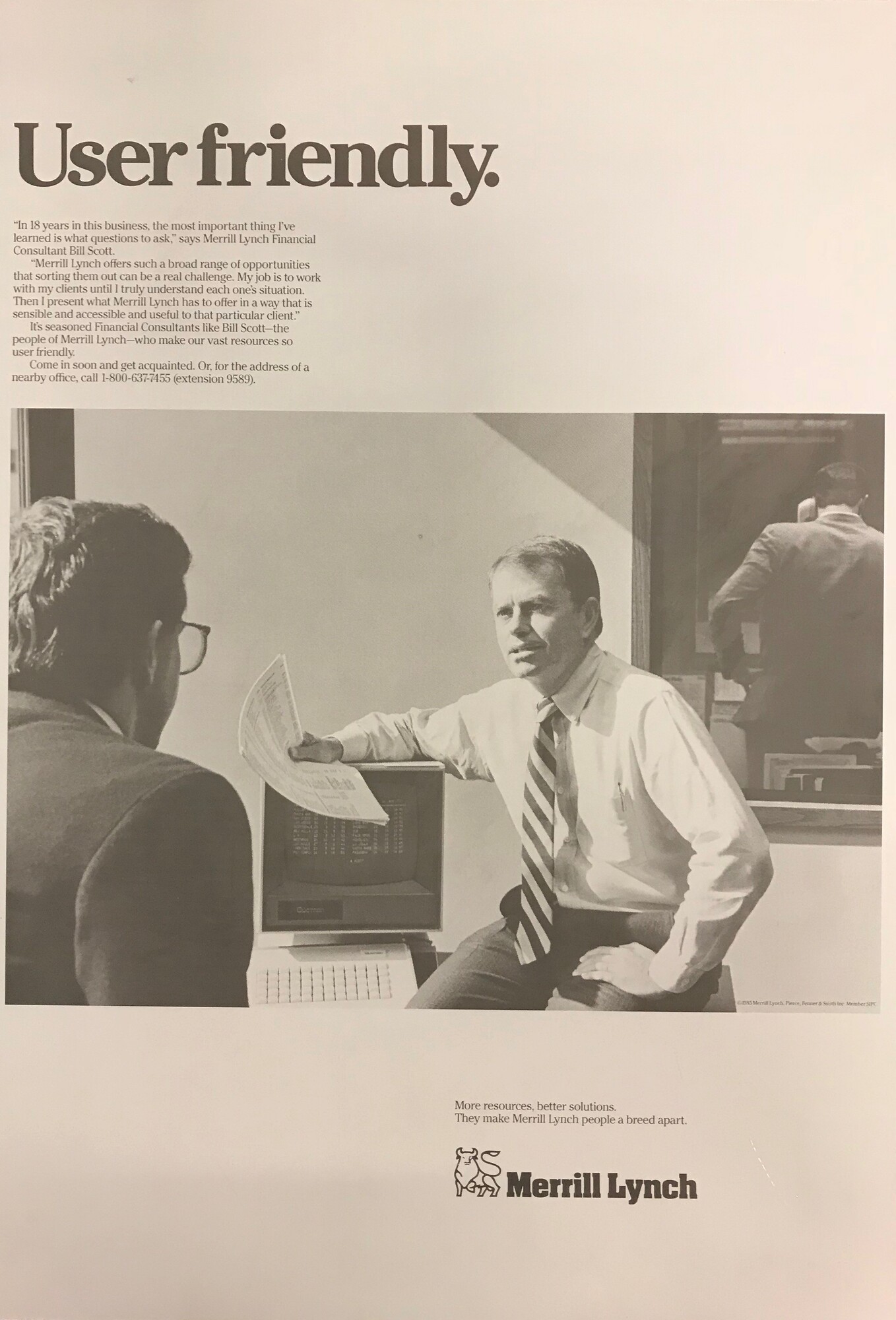

When Kevin Scott joined his father Bill in 1999 to form The Scott Group in Los Angeles, they asked a fundamental question: How do we successfully navigate each client Nest-egg through the increasingly complex global economic environment?

The Scott Group believes that for clients to thrive, with an intelligent and disciplined strategy, an adept Financial Advisory Team needs to bring ever deeper reservoirs of empathy, integrity and wisdom to client relationships.

The multi-generational structure of The Scott Group allows for the team to work extremely well with the different generations of clients’ families, always striving to deliver proactive communication and concierge-level service. We are grateful and invigorated that we are able to define our Team’s success by helping our clients achieve their success.

Along with our skills, we believe our service philosophy is a key reason many of our relationships with clients span decades. Everyone on our team is committed to helping clients on their financial journey by building relationships and striving to provide an exceptional experience.

Since joining Merrill Lynch Wealth Management in 1968, Bill has been singularly focused on delivering superior, consistent results for long-term investors using durable portfolios, rigorous research and integrity. Through the years this approach has helped him build and sustain his practice through market's ups and downs. He is entrusted with over $6.8 billion in client's assets as of October 21st, 2021.

No two people are alike. Consequently, there is no single approach to wealth management that is appropriate for everyone. What matters most to you is what matters most to us. Once we get to know you, your priorities, your goals, risk tolerance, time horizons, liquidity needs and what you want to accomplish over time, only then can the team help you position yourself to identify and address financial challenges and potential opportunities. To that end, we thoughtfully employ our experience and resources to help guide you as you pursue your goals.

Wisdom to us means thoughtfully “marrying” our deep understanding of how a client defines success, with an astute knowledge of the financial markets and liquid investments. The genesis of this marriage is the construction of personalized and durable investment portfolios. A durable investment portfolio results from continually analyzing how the world works, distinguishing reality from emotion, and respecting what cannot be known. Durable investment portfolios of stock allocations own great businesses at a fair price. Very importantly, a durable investment portfolio needs to thoroughly incorporate a client’s comfort with risk. The Scott Group believes any portfolio that doesn’t achieve a thoughtful risk balance is, by definition, not durable.

Integrity is keeping our promise to always deliver in the best interest of our clients. We do what we say. There is no higher value than integrity.

Skill is being committed to produce above average gains inline with our clients risk appetite. Skill is not taking above average risk to outperform, but rather striving for superior performance with less-than-commensurate risk. Thus, rather than merely searching for prospective profits, we place the highest priority on our client's objectives and preventing losses.

Empathy to The Scott Group means beginning each relationship with a thorough discovery process into exactly what clients hope to accomplish through investing. In other words, when clients imagine their future, what exactly does this ideal picture look like? What specifically will their Nest-egg allow clients to achieve? How can income be intelligently generated to support these dreams while avoiding invasion of principal?

For many years, the goal of the Scott Group has been to provide financial advice and guidance and investment management to thriving clients. Our familiarity with the challanges of sufficient wealth, combined with the vast Merrill platform of services and systems capabilities, provide you with a resource to address nearly every financial need - large and small. We are committed to sharing our experience, profesisonal knowledge and network to serve you. Our disciplined process of wealth management is not just investments, estate planning services and education savings. It is about you.

Merrill’s process is designed to help deliver a customized, comprehensive experience to assist you not only in wealth accumulation and preservation, but in areas that go beyond investments. Providing you with access to the investment insights of Merrill, trust and fiduciary services from Bank of America Private Bank, and the banking and lending solutions of Bank of America offers a way to help you manage all of the pieces of your financial life. Working one-on-one with a Merrill advisor means you have a single point of contact to help you with potential strategies for transferring wealth to the younger generation.

Merrill is proud of our advisors who’ve received recognition from financial industry publications or directly from Bank of America Corporation. We believe they are setting the standard for exemplary client service.

Supported by the global resources of Merrill, our team is comprised of talented and experienced individuals committed to building strong client relationships based on trust and personalized service.

The following specialists do not make securities recommendations. Please contact your Merrill Lynch Wealth Management Advisor if you have questions about how a specialist might be able to assist you.

Structured Credit Executive

Bank of America, N.A.

Wealth Strategies Advisor

Bank of America, N.A.

Merrill Personal Wealth Analysis™ can help us build and document a personalized plan, centered on your goals and focused on what you want to achieve.

We understand that both your life and the financial markets can change over time. By checking in to discuss changes in your life and revisiting your financial approach, our goal is to help you stay on track to achieve what's most important to you.

We’ll meet with you to review your goals and the progress you’ve made toward reaching them. We’ll also discuss any adjustments needed to your financial approach to help you stay on course.

Your life and goals change. As these changes occur, we can update your approach to reflect them.

MyMerrill is your online destination for access to your financial information, secure communications, and a robust offering of tools and capabilities.

Your advisor is a click away within our site or mobile apps

You can manage account security with our customizable security capabilities such as touch ID, one time passcode, and other security features

Access to your complete financial life is available with My Financial Picture, Merrill’s asset aggregation tool

Helping you reach your goals starts with getting to know you personally. Through understanding what matters most to you, together we can help you create a financial approach that reflects your personality. Only then can we offer an approach that is built around your life priorities and the advice you need to help you address fluctuations in the market and changes in your life. Let’s work together to help you achieve your goals.

As Merrill Lynch Wealth Management Advisors, we will sort through the financial complexities of your life, helping you build a customized investment approach to address your needs and pursue your goals.

We put you first, every day.

Learn more about the dedicated one-on-one relationship you can have with a Merrill Lynch Wealth Management Advisor.

Transcript of Video

No question too big or moment too small

For every question you have, every decision you make and every answer you need, we are with you to listen and help guide you along the many paths your life can take. Watch this video to see some questions we can address together.

The Power of the Right Advisor®

Working with a dedicated Merrill advisor means you get personalized investment strategies from Merrill plus access to comprehensive financial solutions only Bank of America can deliver.

You are now leaving Bank of America Merrill Lynch.

By clicking Continue, you will be taken to a website that is not affiliated with Bank of America Merrill Lynch and may offer a different privacy policy and level of security. Bank of America Merrill Lynch is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites.

You can click the Cancel button now to return to the previous page.