Personalized advice from a dedicated financial advisor.

We get to know you and your family, your financial situation and what matters most to you.

Learn more about an advisor's background on

FINRA's BrokerCheck

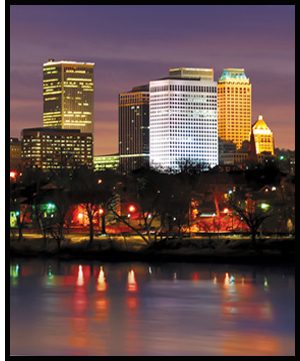

Jelley, Udrisky & Associates is based in Tulsa, OK and understands the style and culture of the American Midwest, but we are active in many other states also and are deeply familiar with the wealth management needs shared by clients across the country.

Jelley, Udrisky & Associates is based in Tulsa, OK and understands the style and culture of the American Midwest, but we are active in many other states also and are deeply familiar with the wealth management needs shared by clients across the country. . So, getting to know you is crucial as we develop a clear understanding of how you see wealth and investments in the context of your life. We consider several elements of your financial life, including your personality and lifestyle, risk tolerance, time horizon, liquidity needs, your individual, family and professional priorities, and how you interpret the role of wealth.

. So, getting to know you is crucial as we develop a clear understanding of how you see wealth and investments in the context of your life. We consider several elements of your financial life, including your personality and lifestyle, risk tolerance, time horizon, liquidity needs, your individual, family and professional priorities, and how you interpret the role of wealth.

Merrill is proud of our advisors who’ve received recognition from financial industry publications or directly from Bank of America Corporation. We believe they are setting the standard for exemplary client service.

Barron's "Top 1,200 Financial Advisors: State-by-State" 2016-2024

Published annually in February - March. Rankings based on data as of September 30 of the prior year.

Forbes “Best-in-State Wealth Management Teams” 2023-2024

Published annually in January. Rankings based on data as of March 31 of prior year.*

Forbes "Best-in-State Wealth Advisors" 2019-2023

Published annually Jan- April. Rankings based on data as of June 30 of prior year.

Financial Times "400 Top Financial Advisers" 2017

Published on March 22, 2017. Rankings based on data as of June 30, 2016.

Supported by the global resources of Merrill, our team is comprised of talented and experienced individuals committed to building strong client relationships based on trust and personalized service.

The following specialists do not make securities recommendations. Please contact your Merrill Lynch Wealth Management Advisor if you have questions about how a specialist might be able to assist you.

Wealth Management Lending Officer

Bank of America, N.A.

NMLS #565738

Wealth Management Banking Specialist

Merrill

Merrill Personal Wealth Analysis™ can help us build and document a personalized plan, centered on your goals and focused on what you want to achieve.

We understand that both your life and the financial markets can change over time. By checking in to discuss changes in your life and revisiting your financial approach, our goal is to help you stay on track to achieve what's most important to you.

We’ll meet with you to review your goals and the progress you’ve made toward reaching them. We’ll also discuss any adjustments needed to your financial approach to help you stay on course.

Your life and goals change. As these changes occur, we can update your approach to reflect them.

MyMerrill is your online destination for access to your financial information, secure communications, and a robust offering of tools and capabilities.

Your advisor is a click away within our site or mobile apps

You can manage account security with our customizable security capabilities such as touch ID, one time passcode, and other security features

Access to your complete financial life is available with My Financial Picture, Merrill’s asset aggregation tool

Helping you reach your goals starts with getting to know you personally. Through understanding what matters most to you, together we can help you create a financial approach that reflects your personality. Only then can we offer an approach that is built around your life priorities and the advice you need to help you address fluctuations in the market and changes in your life. Let’s work together to help you achieve your goals.

As Merrill Lynch Wealth Management Advisors, we will sort through the financial complexities of your life, helping you build a customized investment approach to address your needs and pursue your goals.

We put you first, every day.

Learn more about the dedicated one-on-one relationship you can have with a Merrill Lynch Wealth Management Advisor.

Transcript of Video

No question too big or moment too small

For every question you have, every decision you make and every answer you need, we are with you to listen and help guide you along the many paths your life can take. Watch this video to see some questions we can address together.

The Power of the Right Advisor®

Working with a dedicated Merrill advisor means you get personalized investment strategies from Merrill plus access to comprehensive financial solutions only Bank of America can deliver.

You are now leaving Bank of America Merrill Lynch.

By clicking Continue, you will be taken to a website that is not affiliated with Bank of America Merrill Lynch and may offer a different privacy policy and level of security. Bank of America Merrill Lynch is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, products or services that are offered or expressed on other websites.

You can click the Cancel button now to return to the previous page.