The Cunningham Team

A multi-generation team, created to help optimize, simplify, and automate ones financial life to pursue what’s important to them. The Cunningham Team provides white-glove client service paired with the access and global resources of Merrill to give our clients the highest level of personalized service and care they deserve.

For over 25 years, our team has worked closely with individuals, families, and businesses, helping them streamline the complexities and capitalize on the opportunities of wealth. Our team has been fortunate to be able to work with multiple generations of clients and is one of the primary sources of having clients in over 20 states.

We recognize the importance of capital preservation to clients, sensitive to the sacrifices they have made in attaining their wealth. Our wealth management approach is about using wealth to help turn goals into reality.

The Cunningham Team is one of the most recognized names in Wealth Management in the area, and with the resources of Merrill and Bank of America, we are the essence of bringing access of Wall Street to Bay Street. In 2024, Our team was named to the Forbes "Best-in-State Wealth Management Teams" list (Published on January 9, 2024. Rankings based on data as of March 31 2023.***)

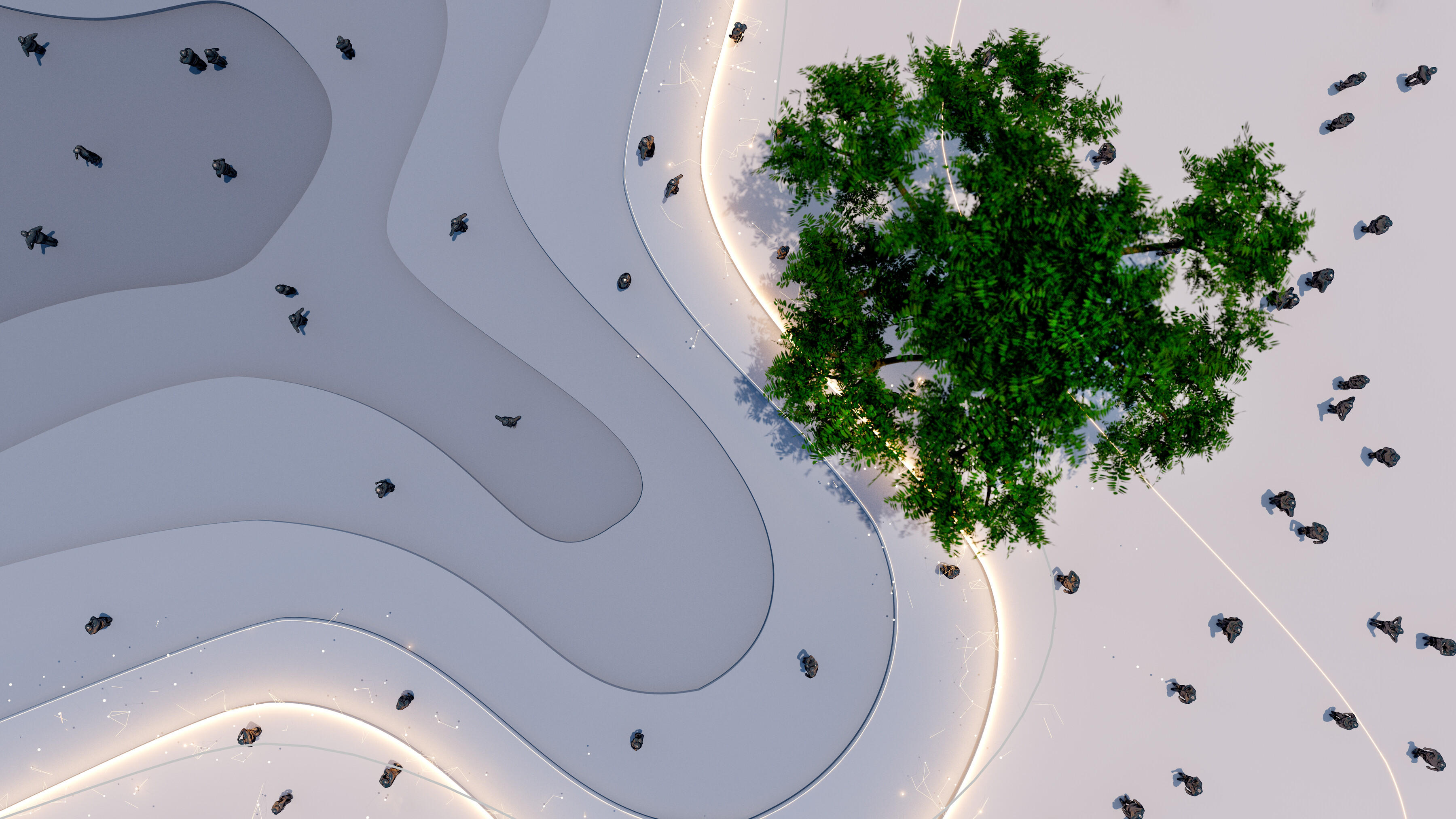

Bringing fresh perspectives to your financial life

The financial decisions you make today can help determine the future you build for yourself and your family. Carving a clear path forward starts with connecting your life and finances. A Merrill advisor provides access to the investing insights of Merrill and banking capabilities of Bank of America to help you make informed decisions as you pursue your goals.